Tariffs and the Future of Global Logistics: How Trade Policies Are Reshaping Supply Chains

The Knowledge Project Podcast with Ryan Petersen | September 29, 2025

Global trade is the backbone of modern economies, and at the center of it all lies logistics—the intricate system of moving goods from manufacturers to consumers across borders. In recent years, one factor has disrupted this flow more than anything else: tariffs. These taxes on imported goods, designed to protect local industries or generate government revenue, have caused ripple effects across supply chains, changing where and how companies produce, ship, and sell their products.

This blog dives deep into the history of tariffs, their real-world impact on global logistics, and the strategies businesses are using to adapt. If you’re a business leader, supply chain manager, or just curious about how trade policies affect what ends up on store shelves, this is for you.

What Are Tariffs and Why Do They Matter?

At its simplest, a tariff is a tax imposed by a government on imported goods. The origins of tariffs date back thousands of years. Long before income taxes existed, countries funded themselves through trade taxes. In fact, in the United States, tariffs were the primary source of government revenue until the Civil War introduced income tax. For decades, tariffs were not just trade tools—they were a nation’s financial lifeline.

Today, tariffs serve multiple purposes:

Government Revenue – Tariffs still contribute meaningfully to national budgets. At one point, tariffs on Chinese imports reportedly covered one-third of the cost of U.S. tax cuts.

Protectionism – They shield domestic industries like steel and autos from foreign competition, ensuring countries maintain strategic sectors for both economic and national security reasons.

Trade Leverage – Tariffs are often used as bargaining chips in international negotiations, whether to pressure rivals or strengthen domestic bargaining positions.

In today’s hyperconnected global economy, the stakes are much higher. When a government alters tariff rates, even slightly, businesses that rely on cross-border trade must rethink sourcing strategies, renegotiate contracts, or even shift entire production lines. This has long-lasting effects not just on corporations but on consumers and workers as well.

Key takeaway: Tariffs don’t just impact governments—they reshape entire global supply chains, from raw material sourcing to final retail prices.

How Tariffs Disrupt Supply Chains

Modern supply chains are unfathomably complex and interdependent. A single consumer product like a smartphone may involve design in California, microchips from Taiwan, screens from South Korea, assembly in China, and shipping through multiple ports before reaching your pocket.

When tariffs suddenly increase, businesses face immediate challenges:

- Increased Costs – Importers must pay higher duties, which often translate into higher consumer prices. In many industries, even a 5–10% tariff increase can wipe out profit margins.

- Supply Chain Relocation – Companies move factories overseas to avoid tariffs, sometimes abandoning decades of “Made in America” branding.

- Inventory and Pricing Chaos – Sudden tariff changes lead to spikes in demand, stockpiling, or production halts as companies scramble to adjust.

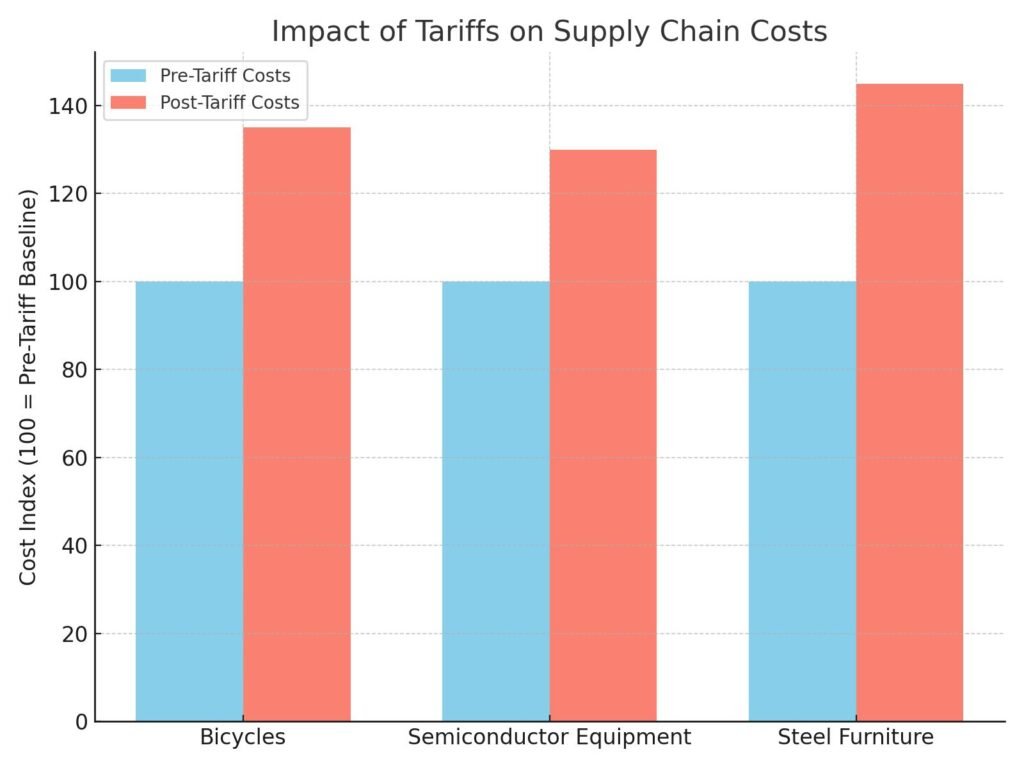

Real-World Example: U.S. Bicycle Manufacturer

One American bicycle company once proudly marketed itself as “Made in the USA.” But when tariffs applied to bike components (while complete imported bikes remained duty-free), their costs skyrocketed. Competitors producing overseas faced no such burden, forcing the company to move its U.S. factory abroad.

Real-World Example: Semiconductor Equipment

A semiconductor fab planned to buy German machinery. When tariffs threatened to raise costs by 30%, the company opted to build its factory outside the U.S. instead.

The irony is that tariffs, which are often intended to bring jobs back home, can end up driving investment and factories further overseas. Supply chains don’t just move—they adapt in the most cost-efficient way possible, even if it contradicts the spirit of protectionist policies.

Key takeaway: Well-intentioned tariffs often backfire, driving companies to relocate abroad instead of reshoring production.

Hacks, Workarounds, and Legal Loopholes

Businesses rarely accept tariffs at face value. Instead, they explore strategies to minimize costs. Some are clever but legal, while others cross into gray or even fraudulent territory.

1. Bonded Warehouses

Companies store imports in bonded warehouses, delaying tariffs until goods officially enter the domestic market. This allows them to “wait out” high tariffs in hopes rates will fall. For seasonal businesses like fashion, this can be a game changer, letting them release products when tariffs or demand conditions are more favorable.

2. Duty Drawback

If a company imports components, pays duties, and then exports finished goods, they are entitled to duty refunds. Shockingly, $7 billion in U.S. refunds go unclaimed annually—even before new tariffs expanded the opportunity. That’s money left on the table, especially for exporters of electronics, vehicles, and apparel.

3. Product Library Tracking

Advanced firms like Flexport build detailed product libraries tracking every subcomponent. For example, instead of paying tariffs on an entire couch containing steel, importers can pay only on the steel portion. Over time, this data-driven approach can save companies millions while ensuring compliance.

4. The First Sale Rule

This legal strategy allows importers to pay tariffs on the first transaction value (e.g., factory-to-agent price), not the final marked-up cost. It’s a sophisticated tactic that requires excellent documentation but can significantly reduce costs in industries like apparel and electronics.

5. Questionable Practices

Some factories act as importers of record, under-reporting values through shell companies. While tempting, customs fraud is the U.S. Department of Justice’s #2 white-collar crime priority, right after healthcare fraud.

Practical Tip: Work with trusted trade advisors. Many cost-saving strategies are legal but require meticulous documentation to avoid penalties.

The Rising Complexity of Global Trade Regulations

Tariffs are only one piece of the puzzle. Businesses must now comply with a web of new trade regulations that extend beyond traditional customs duties.

- Uyghur Forced Labor Protection Act – Requires proof that cotton wasn’t sourced from forced labor regions. Retailers, especially in fashion and textiles, now must implement supply chain tracing technologies.

- EU Forestry Regulations – Companies must trace wood products back to their source, impacting furniture, construction, and paper industries.

- Carbon Border Adjustment Mechanisms – Soon, the EU will require a QR code on every product showing its carbon footprint.

This regulatory trend is no small challenge. It means that a business can no longer just focus on cost and speed. They must also track ethical sourcing, environmental impact, and labor compliance. Manual spreadsheets or outdated ERP systems won’t cut it—businesses need technology platforms that can verify every bolt, fabric roll, and circuit board in their supply chains.

Key takeaway: Compliance is becoming as critical as cost control in global logistics.

Strategies to Reduce Tariff Burdens

| Strategy | Description | Risk Level | Example Benefit |

|---|---|---|---|

| Bonded Warehouses | Delay tariffs until release into market | Low | Avoids paying during peak tariffs |

| Duty Drawback | Refund on duties for exported goods | Low | Recover millions annually |

| Product Library Tracking | Assign tariffs to subcomponents only | Medium | Pay only on steel, not full couch |

| First Sale Rule | Pay based on original sale value | Medium | Lower taxable amount |

| Shell Importer Schemes | Factories under-report import values | High/Illegal | Risk of DOJ prosecution |

Lessons from Flexport: Technology Meets Trade

Flexport, a tech-driven logistics firm, embodies how companies must adapt to this new world. By digitizing trade compliance, tracking subcomponents, and using AI for customs classification, they’ve turned complexity into an opportunity.

Their approach proves that supply chain transparency is not optional anymore—it’s a competitive advantage. For instance, by building systems that connect importers, freight forwarders, and customs agents, Flexport allows companies to see in real-time whether their goods are compliant and where tariff savings might exist.

The lesson is clear: the future of logistics is not just physical movement, but digital mastery of data. In a world where one customs misclassification can wipe out weeks of efficiency gains, companies must adopt technology not just to stay competitive but to survive.

Looking Ahead: The Future of Global Logistics Under Tariffs

Tariffs will continue to be a political tool—used to protect industries, raise revenue, and pressure rival nations. But their unintended consequences are clear:

- Factories may continue moving abroad instead of returning home.

- Consumers will pay more, often without realizing why.

- Regulatory compliance will dominate supply chain strategy, requiring investment in technology and legal expertise.

- Geopolitical risk management will become part of every CEO’s playbook, as trade wars and sanctions shape supply chains as much as market demand.

Practical Tip for Businesses: Start preparing now. Build data-driven systems that track every component, partner with trade advisors, and explore legal cost-saving strategies like duty drawbacks. More importantly, develop a proactive compliance strategy so you aren’t caught flat-footed when the next wave of tariffs or trade rules hits.

Conclusion

The global logistics industry is entering a new era—one defined by tariffs, compliance, and technology. Businesses that treat tariffs as just another cost will struggle. Those that see them as a strategic challenge to outmaneuver will thrive.

In short:

- Tariffs increase costs and chaos across global supply chains.

- Real-world examples show that protectionist policies often backfire, pushing factories abroad.

- Smart strategies like bonded warehouses, duty drawback, and product tracking can minimize tariff burdens.

- Technology and compliance are the future, not just freight capacity.

Global trade may be more complicated than ever, but complexity is also where innovation thrives. The winners will be the companies that adapt fastest.

Related Post